The Story Of Mark Cuban And Broadcast.com

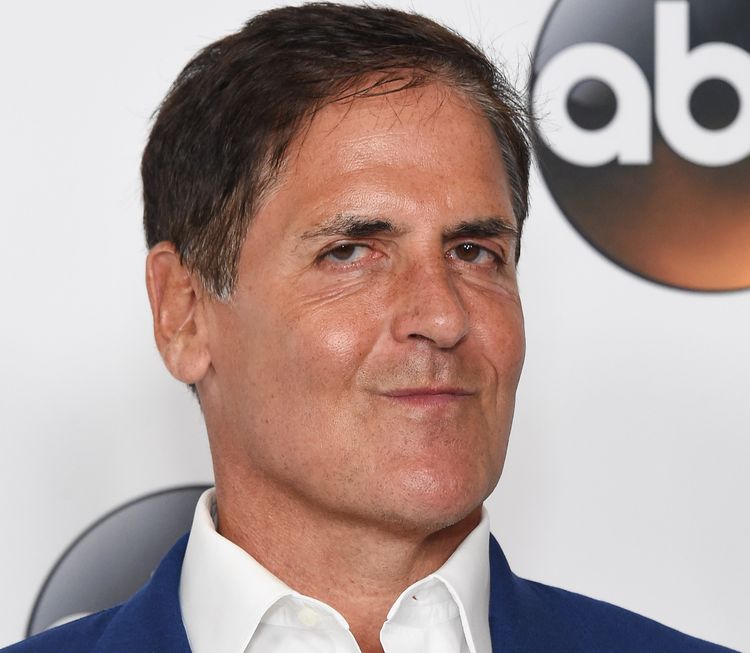

Mark Cuban is a name that has become synonymous with the hit TV show Shark Tank. Not to mention his over ventures as owner of the Dallas Mavericks basketball team, as well as being a billionaire entrepreneur ranked #177 on the 2020 Forbes 400 list.

But did you know he was also the brains, along with his partner Todd Wagner, behind Broadcast.com? Which means that Cuban can add “pioneer in the field of accessing streaming content via the Internet” to his long, long list of successes.

In essence, Cuban assumed the mantle of visionary when he brought streaming video to the internet well before it was feasible. In the mid- to late-90s, high-speed internet was not sufficiently established to allow for video content to be accessed by the masses. Dial-up worked well enough for audio feeds but was nearly useless when it came to watching any form of video.

Just Wanted To Follow Basketball

The fairytale story of Broadcast.com begins when Cuban and Wagner graduated from the University of Indiana, moved away from Bloomington, and were no longer able to follow Hoosier basketball. Allegedly, their love of watching basketball became the inspiration for creating universal audio content that would enable them to follow to their favorite team via the internet.

That’s when Audionet.com was born.

The formation of Audionet.com in 1995 set the stage for the introduction of Broadcast.com, which led to the record-setting IPO of Broadcast.com in 1998, and culminated in 1999 when Yahoo assimilated Broadcast.com in a deal valued at $5.7 billion.

A Great Deal

As was common during the internet bubble, companies such as Yahoo didn’t pay for acquisitions in cash; instead, they used their own stock as currency. Yahoo issued the equivalent of $130 per share in Yahoo stock to the owners of Broadcast.com to fund the acquisition.

When Yahoo acquired Broadcast.com in 1999, the company had recorded approximately $100 million in revenue the prior year, which valued the company at 57 times its revenues. Before that, Broadcast.com had never turned a profit and had actually lost millions of dollars.

Broadcast.com had only been able to afloat until its IPO in 1998 because of the original $1 million in capital that Cuban had supplied to get the business off the ground, and a private placement of $26 million that temporarily capitalized the company.

When Broadcast.com was taken public it had less than $7 million in revenues, $28 million in equity, and an accumulated deficit of nearly $10 million dollars. It seemed as though the company had little or no chance of achieving profitability in the foreseeable future; nevertheless, the company’s IPO came in at $18 per share in 1998, and before the market closed on its first day of trading the stock had appreciated to $62 per share. Suddenly, Mark Cuban had a paper net worth of nearly $100 million.

Cuban kept his eye on the future, and sought to lock in the paper value of his new Yahoo stock, which had a market value in excess of $1 billion. He and Wagner turned to Goldman Sachs and requested that the investment bank structure a collar involving Yahoo stock that locked in the value of their paper profits.

The rest, as they, is history. And Mark Cuban’s rise to being one of the richest men in the United States is certainly one for the books.