Watch Out For These 8 Huge IPOs In 2021

I woulda…coulda…shoulda…gotten in on that IPO.

Maybe you’ve experienced the regret that comes from missing out on some of the really great initial public offerings (IPOs) that have come down the pike in recent years (DoorDash and Airbnb to name a few). But new investment opportunities in the world of stocks are always coming into play, and knowing which ones are considered ‘hot’ prospects can mean the difference between boom and bust.

Check out these eight top IPOs that investors are looking to get in on during 2021. This could be the year when you gain in the market and lose the regrets.

Robinhood

No commissions. No trading fees. No wondering where your money is going. With Robinhood, every dollar you make stays right in your account, so it’s not surprising that more than 13 million users rely on this app for their investing. Goldman Sachs is leading the preparation for a 2021 IPO, which could value Robinhood at more than $20 billion.

Stripe

Although Stripe denies it’s planning an IPO, there’s plenty of market buzz that suggests otherwise. A payment processing platform, Stripe is focused on the continuing shift in consumer behavior that tends to favor digital, rather than cash, payments. To date, Stripe is the power behind the transactions of big names like Lyft, Pinterest, Instacart, and Amazon. According to Bloomberg, the fintech company might be in line for another round of funding, which could boost its valuation to $70 billion or even as high as $100 billion.

Coursera

Even before the COVID-19 pandemic hit, online learning was key for individuals looking for professional certifications and degree programs that fit their busy schedules. Coursera, with a roster of more than 200 universities and companies, is considering an IPO that would raise its valuation to close to $5 billion, according to Bloomberg.

Nextdoor

What’s next in the world of community-focused IPOs? Apps like Nextdoor. Whether you’re looking to sell some no-longer-needed furniture, find the best places to shop nearby, or announce a neighborhood event, Nextdoor can serve as the digital version of ye olde town crier. The app now includes some 250,000 neighborhoods in 11 countries, and is targeting a valuation between $4 and $5 billion.

Bumble

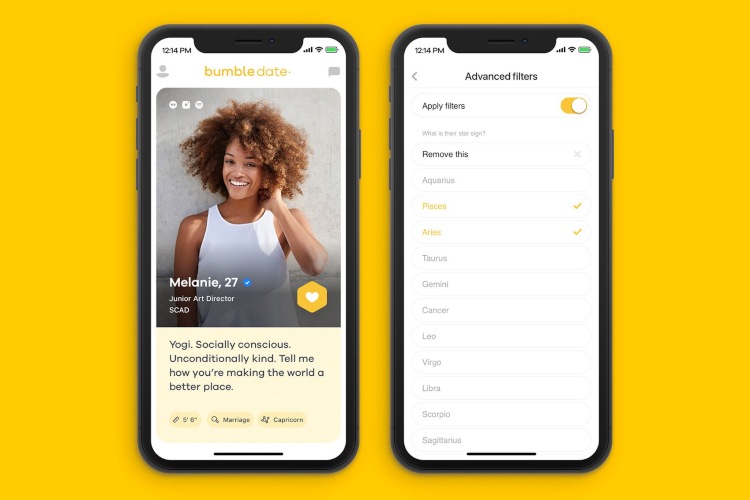

Nothing inspires an uptick in virtual dating like a pandemic that has closed bars, silenced nightclubs, and made meeting up in coffee shops a cautionary tale. Although Tinder remains at the top of the list when it comes to dating apps, Bumble is giving it a run for its money by focusing on dating as well as social and professional networking.

In addition, the female-first app only allows women to initiate contact when heterosexual singles match, which seems to resonate with users: According to BNN Bloomberg, Bumble is looking for a 2021 public offering with a valuation of $6 billion to $8 billion.

Instacart

Here’s an IPO that is (dare we say it) poised to deliver big. Instacart, an online grocery delivery company, has partnered with more than 500 retailers to offer delivery from nearly 40,000 U.S. and Canadian locations. IPO rumors continue to swirl around the company, although no definitive filings or announcements have made the news. Reuters, however, reports that the company has enlisted Goldman Sachs to assist with an IPO valued at nearly $30 billion.

GitLab

GitLab, which helps developers share and manage code, had planned an IPO for November 2020, but the COVID-19 pandemic, and the subsequent tanking economy, got in the way. While waiting for better economic news, GitLab is getting going on another front: The company is allowing some employees to sell their equity in an offering that values GitLab at more than $6 billion, according to CNBC.

Squarespace

Designing and hosting your own website comes full circle with Squarespace — and you can kiss coding goodbye! Word is that the company plans to pursue an IPO in 2021, and is looking to exceed its 2017 valuation of $1.7 billion.