A Beginner’s Guide To Landing Your First Mortgage

The path leading up to purchasing your very first home appears long and winding. And as you venture along it, the inevitable mortgage step can seem especially daunting. Following these steps can ensure that you don’t trip too much along the way…

Graduate From SAT Scores To GPAs To Credit Scores

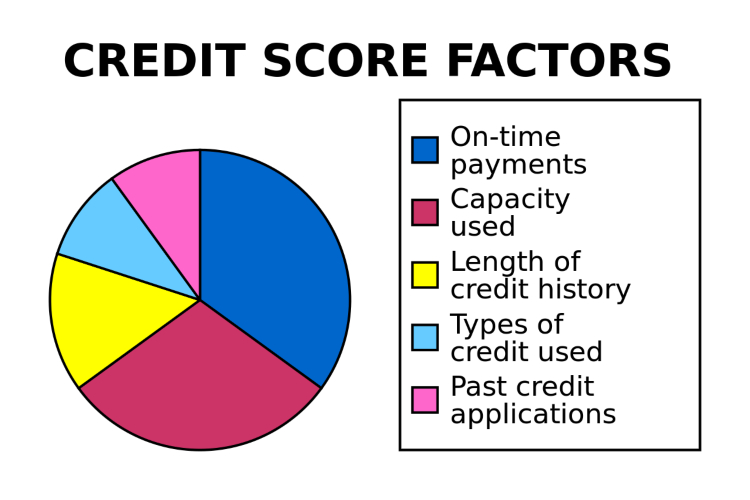

Remember when your SAT score helped determined where you could apply to college? Well, your credit score determines who loans you money, how much, and on what terms. Unfortunately, you can no longer use the “I don’t test well” excuse, because the “test” grades you based on your life’s financials.

The higher your credit score, the more trustworthy a bank deems you, and the lower your mortgage rate. There are various ways to find out (and improve, if necessary) your credit score.

Gather Bank Statements And Proof Of Income

Lenders need a glimpse of your income and expenses, as well as how much you’re sitting on at the bank. Anything sketchy could be a red flag, so be cognizant of your purchases.

You’ll need to prove how long you’ve been at your current job, and how much you earn monthly (which can be shown through pay stubs). Now is also the time to think about whether you’re earning income in any other fun ways, like stock dividends, so remember to note those, as well.

Don’t Let Your Eyes Be Bigger Than Your Wallet

In other words, know what you can and cannot handle in terms of mortgage payments for your home. While laws now exist to help ensure this doesn’t happen, keep an eye out for yourself, too. There are numerous calculators out there to help you determine what’s reasonable and feasible.

Don’t Burn Bridges With Your Landlords—Or Bosses

Your tenant’s reputation travels quickly. Proof that you’ve stayed put and paid on time goes a long way for banks. This goes for jobs, too.

Put That Tax Folder To Work

You know how the second you file your taxes, you mentally destroy everything in that year’s “tax folder” (but never physically, hopefully)? Luckily, your trusty file folder will once again serve a purpose. Lenders want to see tax returns from at least the past two years to prove income consistency.

You’d Better Shop Around

In mortgages, as in most things in life, a good rule of thumb is to get a second opinion. And third. And fourth. It sure doesn’t hurt, and if you get pre-approved, you can at least have an idea of your budget from the get-go. Don’t be lured in by loans with rates that seem too good to be true, because they probably are.

When In Doubt, Hire A Professional

Seriously, the mortgage process can be maddeningly overwhelming, especially for a first-time home buyer. Why not have someone by your side who knows the market, and has dealt with people in (or close to) your particular situation numerous times before? Having an advocate can go a long way in the complicated world of real estate. Your broker can also handle such closing activities as paperwork, title transfer, and inspections (which all cost additional money, just FYI).

While the home-buying process itself can certainly be demoralizing, when you finally climb up all those steps and pull out the shiny key to your new home, you’ll experience a feeling you’ll never want to forget.